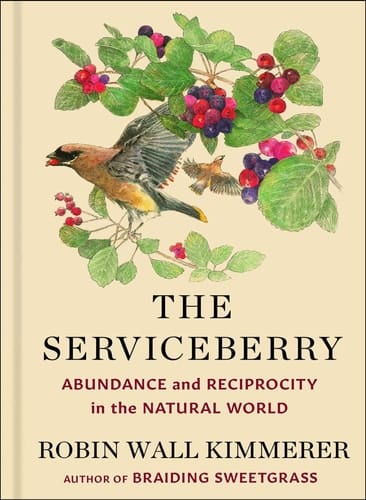

Serviceberry Abundance approach: In her book The Serviceberry, Robin Wall Kimmerer explores the concept of gift economies through the lens of nature, particularly focusing on the serviceberry tree. Read Kimmerer’s book because it reflects on how this tree embodies reciprocity and interconnectedness.

As Silver Sage Village community members revisit the HOA dues structure, Serviceberry Abundance suggests that true wealth comes from relationships and sharing rather than competition and scarcity.

Serviceberry Abundance is relational, rooted in values, and reinforces legal parity and ownership rights.

Unlike traditional HOAs, the SSV budget is values-based cultural acts that reaffirm who we are and how we want to show up for one another. Traditional HOAs operate with rigid assessments and legalistic penalties. Cohousing, by contrast, draws on reciprocity rather than equality-as-sameness, compassion rather than competition, and community resilience rather than individualism.

Through the Serviceberry Abundance lens, we see our community as an ecosystem where resources ebb and flow, where different species thrive in various ways, and where the health of the whole depends on the generosity of the parts.

Resources circulate in Serviceberry Abundance.

Those with more give more, and those with less receive more as reciprocity, strengthening the relationships that make a community whole. Shared living thrives on mutuality. As a different way of looking at each condo, in addition to square footage, SSV Treasurer Gordon illustrates this with his analysis of market-rate condo values compared to the affordable condo values. While property value may not be a part of any dues recalculation formula, the disparities illustrate that mutuality has different layers.

Every community eventually reaches a moment when SSV needs to dry-clean its social fabric. For Silver Sage Village, that moment is approaching as we look toward 2032 and beyond, when the HOA will have drawn down its retained savings to cover major capital expenses, such as painting the building exteriors.

The SSV’s impending revenue shortfall isn’t a crisis. It’s the natural cycle of shared assets reaching the end of their lifespans. What matters is how we respond. After the HOA depletes those reserves, we will need a plan to rebuild them.

How to determine the HOA dues allocation has fallen to the Finance & Legal team. We began discussing this topic at a special F&L budget meeting, at which several Silver Sagers showed interest. As last time, F&L wants to set up a working group to address the HOA dues structure.

Depending on your fear level, some of us believe dues should increase marginally. Fiscal conservatives among us say to increase revenues by 10 to 15 percent over the next 4 to 5 years.

Everyone at Silver Sage is aging. Despite the belief that “age is just a number,” our physical ability and mental acuity ain’t what they used to be. The proposed process, which the dues working group can accept, reject, or tweak, includes self-evaluation and how that affects our abilities to participate in the upkeep and maintenance of the community.

Before the 2027 budget year, our community will decide how to generate enough revenue to sustain us through the next decade and into the next generation of Silver Sage residents.

Some Sagers are staunchly opposed to changing the existing dues structures. Others are adamant that the way dues are figured should be changed to be equal. There will be contentious discussions. The last time the community changed how we calculate dues, some members threatened to move if the dues became too high. It won’t be surprising if members repeat this ultimatum.

Team members Margaret and Agaf compiled a history of the most recent formulae and community values, including transparency and equity, which the working group will discuss.

Rather than focusing right away on our current formula and possible revisions, F&L suggests that we step back and reflect first on the personal and community values, expectations, financial situations, and legacies that underlie any decisions we might make about how to allocate community expenses.

Bubbles before Boxes: F&L suggests we use a “Bubbles before Boxes” approach to elicit these factors. SSV has a history of evaluating complex issues using the Bubbles before Boxes approach.

Bubbles are the personal realities that shape your participation in the community, shaped by your financial personality, health trajectories, household resources, abilities, and values. Understanding one another’s bubbles lets us plan not from fear or scarcity, but from compassion, honesty, and realistic expectations about the future.

Boxes are the solutions comprised of collective strategies for raising revenue, cutting costs, sharing abundance, and adapting as our abilities and financial capacities evolve. When we map bubbles to boxes, we turn individual stories into community wisdom.

Silver Sage’s upcoming revenue shortfall is a case study for both forming and existing communities. Now is always the right time to understand each other and imagine new possibilities together.

Personal bubbles: Before we run the numbers or rearrange budget lines, understanding ourselves and each other is the first important task. The Dues Working Group will determine how to collect bubbles. Here are some suggestions.

The reactionary model jumps immediately to the numbers. Do we raise dues? What expenses can we cut? Are there new revenue sources? All important questions, but not the first questions.

Determining our futuristic bubbles begins with community-building strengthened by the serviceberry economy of reciprocity tuned by lived cohousing wisdom. When we brainstorm bubbles, where do we perceive ourselves and the community?

- Health and mobility projections: Will you still be driving in 5–10 years? Will you be able to haul patio furniture or trim weeds? Will you be able to keep your home clean and safe?

- Emotional and mental capacity: Will you have the energy for volunteer work? Will you need more mental support than when you were younger? Will you have the mental capacity to attend meetings and make decisions?

- Aesthetic and lifestyle values: How important is a lush green lawn compared to a more sustainable native landscape? What feels like “home” to you? What kind of neighborly relationships will you expect?

- Personal financial runway: Can you absorb increases in dues of 10 to 15 percent for the next three or four years? Do you foresee needing a more modest approach? Will you have to move if the HOA dues get too high?

- Will you be here in 5-10 years: What is your life expectancy? Are you planning to leave SSV if assisted living is your next stop along the aging pathway? Have you had enough of cohousing and are tired of living here – meetings, people, work

Our self-perceived bubbles are confessions and truths. Before a community can make fair, sustainable financial decisions, each household must understand the inner landscape of values, health issues, habits, and tendencies that shape how we approach money.

Monetary Personality Bubbles: One helpful tool is a financial self‑assessment, which isn’t about presenting each member’s investment portfolio but rather each member’s “money personality.

I watched a segment on one of the morning TV shows a couple of weeks ago about money personalities. A money personality activity would be a fun exercise. Spending habits, emotions, and priorities shape each of our relationships with money. The guest spoke of categories along a continuum into which people fit.

- Savers. Prioritizing security builds a cash cushion and avoids debt. Savers may miss opportunities or experiences. They balance saving and enjoyment, but may feel inconsistency or guilt.

- Spenders. Enjoying money for pleasure or lifestyle means spenders live in the moment. Spenders may accumulate debt or under-save.

- Moneymakers. An ambitious, income-focused nature characterizes moneymakers. They may neglect savings if they keep investing in a project. A job drives moneymakers, which can throw their work and life out of balance.

- Avoiders. Detachment from money can lower stress levels. Avoiders risk overlooking budgeting, investing, or planning.

- Worriers. If you’re anxious about losing money or running out, you may be a worrier. They take a conservative approach and avoid frivolous spending, but may miss growth opportunities.

Each of our relationships with money is shaped by spending habits, emotions, and priorities. What your investment portfolio looks like is less important than understanding the tendencies that help you make decisions that align with your natural style while also recognizing how your choices may affect the wider community. When it comes to financial personalities, we’re all different.

Mapping our financial personality bubbles helps each of us see tendencies and anticipate how they might influence practical community box solutions.

Market-Rate vs Affordable Condo Value: If we use a serviceberry abundance lens to allocate our expenses among community members, one possible approach suggested by our Treasurer, Gordon, is to consider unit appreciation and the resulting equity.

In our SSV community, the numbers are stark. Our treasurer analyzed the value of our 16 properties. These data are for comparative and illustrative purposes. A new formula will likely continue to be based primarily on square footage with data-driven revenue enhancements.

- 6 homes are part of the City of Boulder Affordable Housing Program, valued at around $1M in total, each with deed-restricted appreciation.

- 10 homes are market-rate, collectively valued at around $10M, and appreciate with the market.

In cohousing, we repeat the mantra that every home is equal. Legally, that’s absolutely true. Each SSV household, regardless of square footage, price, or market trajectory, owns a 1/16 undivided interest in the land, the buildings, the infrastructure, and the shared life unfolding in between. We make decisions collectively. We distribute participation responsibilities equitably. The commons belong to all of us.

Economic Reality Is More Textured: The City of Boulder Affordable Housing Program caps the appreciation for its six SSV homes. The smaller condos are stable, safe, and secure, but they do not appreciate at the same rate as the ten market-rate homes, whose valuations rise or fall with Boulder’s real estate market. Over the next decade, if current market conditions persist, the difference in accumulated equity is projected to widen significantly.

This imbalance isn’t anyone’s fault. It’s the predictable outcome of a market-based housing model nested within a community-based one, which is where Serviceberry Abundance may offer a wiser, more compassionate lens.

After each household reflects on their income stability, long-term financial outlook, health changes, mobility, future care needs, and money personalities, a community-aligned way may emerge for those with greater long-term appreciation to “share abundance,” not as a fee, but as gifts to the commons that strengthen the whole for years to come.

When those with appreciating wealth offer a little more, they are feeding the commons by giving the serviceberries back to the soil that nourished them.

Boxes reflect our realities: Once we fill bubbles with the projected futures of ourselves and the community, boxes define solutions for raising revenue, lowering costs, and creatively leveraging community resources. Once the bubbles are laid out visually, honestly and without judgment, we can add the concrete box strategies that respond to them. The most important thing to keep in mind is to scribe boxes that account for the most bubbles.

No boxes will be off the table.

Beginning in 2026, SSV will be intentional about its bubbles, understand its diverse financial realities, build systems that support reciprocity rather than uniformity, and avoid the economic problems we project will surface years later.

When economic diversity is assumed from the start rather than discovered after move-in, a community can create structures that prevent strain, conflict, and shortfalls down the road.

The combination of bubble awareness and box solutions leads to an understanding of how our financial personalities protect each household and strengthen the whole community.

Decisions about budgets, dues, and shared investments become less transactional, more relational, and SSV operations are budget-friendly by design.

When SSV faces a significant capital expense, such as painting the building exteriors, the conversation should focus on the numbers and forecasts, while accounting for how each household’s future financial and physical capacity will affect contributions and participation.

Thoughtful planning at the onset for budget-friendly cohousing means avoiding financial woes down the road. Thinking about capital reserve strategies, equitable dues models, shared-resource tools, expectation setting, clarity about labor contributions, and transparent financial communication keeps surprises to a minimum and trust to a maximum.

Self-awareness and intentional social design transcend spreadsheets to become a generous community with foresight and connection, turning money, skills, and shared purpose into nourishment for everyone. It proves that housing efficiency is about designing a system where no one lags behind, and no one carries the load alone.

When the bubbles (our truths) and the boxes (our solutions) sit side by side, we create a foundation where money issues become less daunting and more about possibility. Serviceberry Abundance leads us to resilient communities. From shared clarity, communities can shape budget-friendly practices that honor dignity, diversity, and reciprocity.

When Silver Sage is a newly dry-cleaned community, we can turn to the practical side and reimagine ourselves as more emotionally and financially efficient.